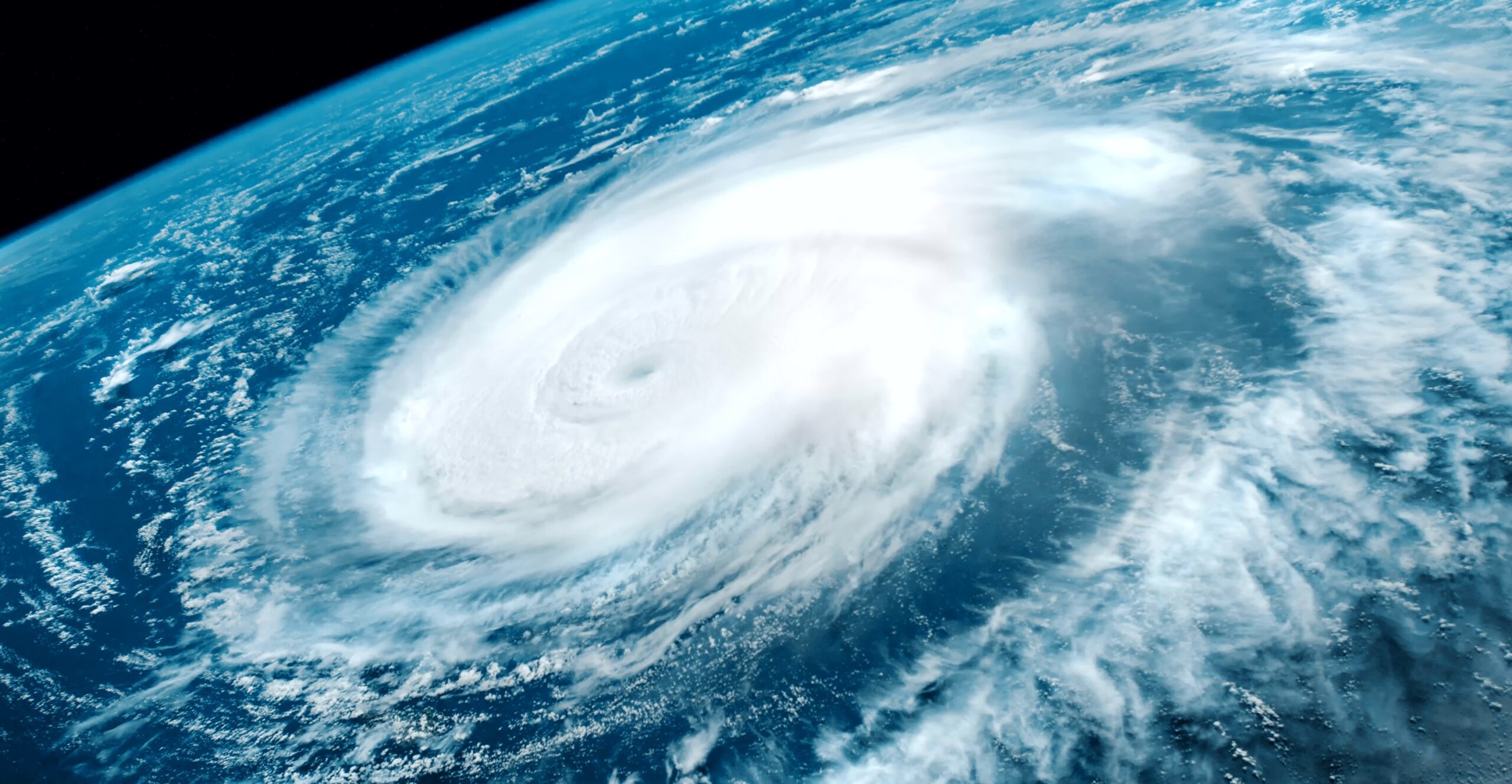

As the 2024 hurricane season unfolds, insurance companies prepare. Late summer is time to closely monitor hurricane forecasts, assess risks, and account for financial implications that could arise due to increased property and casualty claims.

The year 2024 has brought renewed attention to the impact of hurricanes on the insurance industry with experts projecting an above-normal hurricane season.

WaterStreet Company P&C insurance solutions allow carriers to access all the data needed to form predictions on where these costs are headed.

2024 Hurricane Season Forecasts

According to the National Oceanic and Atmospheric Administration (NOAA), 2024 is anticipated to have another above-normal hurricane season, with an above-normal chance of 85%. The prediction includes up to 25 named storms as the NOAA has cited near-record warm ocean temperatures, La Niña conditions in the Pacific, and reduced trade winds.

According to the Insurance Information Institute (Triple-I), insurers must prepare for a very active 2024 hurricane season. While a typical hurricane season may encounter 14 named storms, experts with Triple-I forecast 23 named storms. The Triple-I offers a strong recommendation for all to prepare, from homeowners and renters to business owners and landlords.

This May, Yale Climate Connections highlighted a dismal precursor to support the above-normal predictions. The Atlantic Ocean’s tropical belt, a span of the Atlantic Ocean stretching from Central America to Africa, is exceedingly warm, surpassing ocean temperatures behind the most expensive hurricane on record.

The 2005 season of Hurricane Katrina experienced 67% of the tropical belt at or near record warmth, while this year’s recordings have shown 90% of the belt at or near record warmth. As temperatures rise within this key region, storms pull a greater amount of water vapor and heat for stronger winds and heavier rainfalls. Hurricanes formed within the Atlantic tropical belt make landfall along the East Coast and Gulf of Mexico, affecting highly populated areas.

These predictions have important implications for insurance companies, heightening the need for a well-prepared claims process and expectations for losses resulting from hurricane-related damages.

Prepare for Costs and Implications

The forecasted above-normal hurricane season raises concerns for insurance companies due to the potential for increased payouts related to property damage and loss.

The 2024 hurricane season has so far affected Texas with Hurricane Beryl on July 8th, causing up to $3 billion in insured losses. Hurricanes primarily affect states along the Atlantic Basin, stretching from Texas to Florida and up to Maine, between the months of June and November.

Insurers must allocate resources to manage the surge in claims that could arise from the destruction caused by hurricanes, including wind damage, flooding, and business interruption.

Hurricanes Past and Present

A record-breaking 28 named storms occurred in 2005, including Hurricane Katrina with an estimated $125 billion in nominal damages. The 2005 season resulted in substantial insurance losses, emphasizing the importance of accurate predictions and effective risk management strategies.

These are the top most expensive hurricanes to hit the United States by nominal damage:

- Katrina, 2005 – $125 B

- Harvey, 2017 – $125 B

- Ian, 2022 – $113.1 B

- Maria, 2017 – $90 B

- Irma, 2017 – $77.2 B

Comparing the predicted above-normal activity of the 2024 hurricane season to historical data and lessons learned from past devastating seasons, insurance companies are taking proactive measures to mitigate potential losses.

Improved risk assessment, enhanced claims management processes, and strategic partnerships with reinsurance companies are some of the strategies being employed to brace for the impact of the predicted hurricane season.

Hurricane Hilary

During the 2023 hurricane season, Hurricane Hilary will be remembered as a significant and unexpected event that left a lasting impact on Southern California. While hurricanes are more commonly associated with the Atlantic and Gulf coasts, the unusual trajectory of Hurricane Hilary brought unprecedented challenges to a temperate region.

As reported by Reuters, the fury of Hurricane Hilary was unleashed on Southern California, catching many residents off guard. The storm’s powerful winds and heavy rainfall resulted in widespread damage, particularly in coastal areas. Homes, infrastructure, and coastal ecosystems experienced extensive damage, prompting emergency response efforts and enhancing future preparedness strategies in regions less accustomed to hurricane threats.

AccuWeather emphasized that Hurricane Hilary’s impact serves as a reminder that no area is entirely immune to the influence of tropical systems. The storm’s trajectory was influenced by complex meteorological factors, including a marine heatwave off the California coast.

In the aftermath of Hurricane Hilary, insurance companies in the region mobilized to assess the extent of the damages and process claims from policyholders. This incident underscores the importance of adaptable risk assessment models that account for the potential reach of hurricanes beyond their traditional domains.

The unexpected impact of Hurricane Hilary on Southern California serves as a reminder that climate-related events can defy geographical expectations. As climate patterns continue to change, insurance experts must remain agile in their risk assessment strategies, considering the potential for outlier events. By learning from events like Hurricane Hilary, the insurance industry can continue to enhance its ability to safeguard communities and assets against the unpredictable forces of nature.

Risk Assessment and Mitigation

Insurance companies leverage advanced technologies and data analytics to refine risk assessment processes. Insurers can better estimate potential losses and allocate resources by analyzing weather data in a number of ways.

- Historical hurricane patterns

- Geographic vulnerability

- Building structure durability

Insurers have also invested in Catastrophe Modeling, which helps measure the impact of catastrophic events on insurance portfolios. With this technology, insurance professionals can test disaster scenarios, such as severe storms, in order to strategize the company’s response in the case of such an event.

This proactive approach enables insurance companies to offer policies with appropriate coverage limits while minimizing financial exposure.

To help prepare policyholders, insurance companies are emphasizing the importance of risk mitigation for policyholders. Education about hurricane preparedness, incentivizing property upgrades that reduce vulnerability, and promoting flood insurance are essential components of a comprehensive strategy to minimize damage and claims.

Collaboration with Reinsurers

The predicted above-normal hurricane season has also prompted insurance companies to reinforce their relationships with reinsurers. Reinsurance plays a critical role in spreading the financial risk associated with catastrophic events like hurricanes. By sharing a portion of liabilities with reinsurers, insurance companies can better manage the potential surge in claims and maintain financial stability in the face of significant losses.

WaterStreet P&C Solutions

Predictions for the 2024 hurricane season underscore the need for insurance companies to remain vigilant and prepared. Through strategic risk management and a commitment to resilience, insurance companies aim to navigate the stormy waters of the 2024 hurricane season while fulfilling their vital role in protecting communities and property.

WaterStreet Company provides insurers with cloud-based solutions and an advanced API for your solution to grow with the company. We understand the importance for carriers and MGAs to adapt to market changes. Reach out today for a demo of our solutions.