The quote to bind ratio is important to track the performance of products. There can be many different ways of looking at the quote to bind ratio depending on the product type. In all, seeing an improving or declining quote to bind ratio helps insurers monitor the performance of products. When few customers are making it from the quote to bind steps, analysis must be done to determine if the product is profitable.

Many different roles across the insurance company have reason to review the quote to bind ratio on products, including Underwriters, Customer Service Managers, Operations Managers, Marketing Managers, Product Managers and Executives.

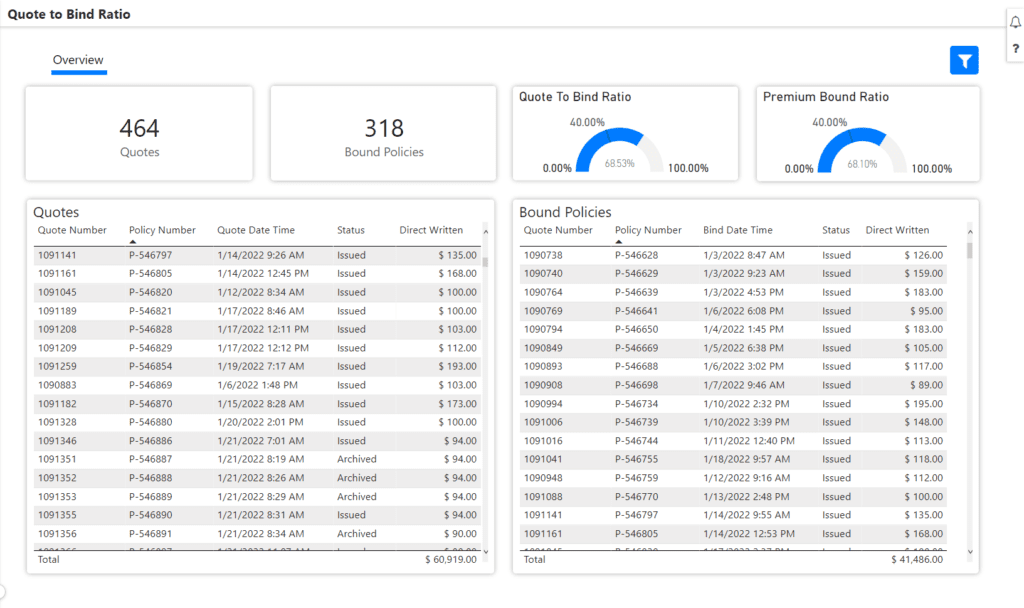

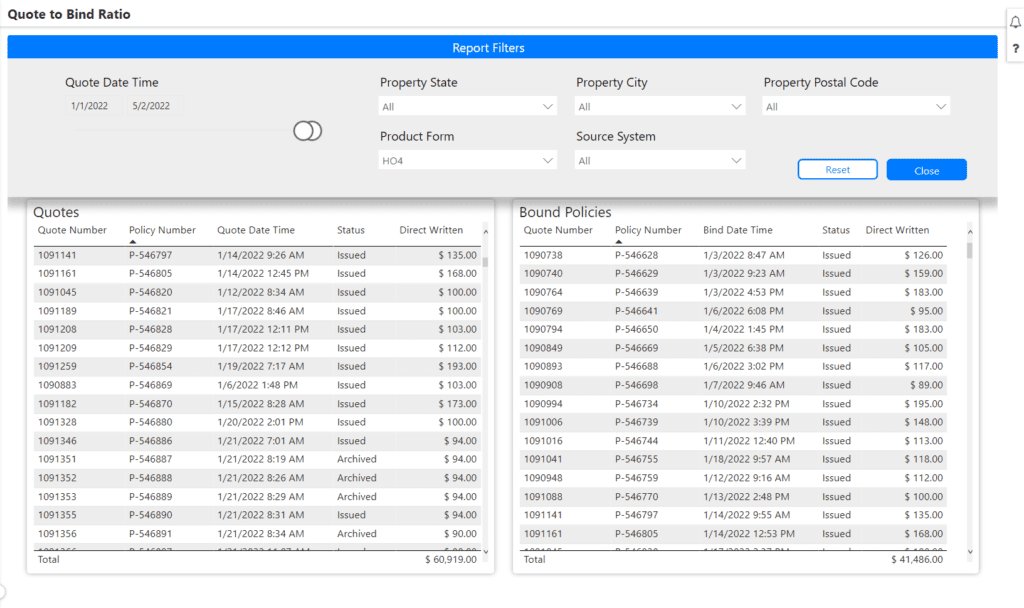

WaterStreet Company makes it easy to review and compare key information about the quote to bind process with our Business Intelligence Suite, including:

- Analyze conversion statistics for quotes created by time range.

- Track close rate goals by product.

- Identify how many quotes converted to bound policies and compare by date ranges.

Quote to Bind Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

Why is it important for my business to track the Quote to Bind ratio?

The Quote to Bind Ratio helps to indicate the success of a product. This performance metric can vary widely by carrier and agent and depends on the type of product, policy systems’ rules, and business model of the agent.

The quote may only occur when the agent believes they will bind the policy, the agent may use comparative rater programs, or the agent’s business model may dictate many quotes should be generated regardless of low bind ratios. From the carrier’s perspective, the ratio is still a key indicator for all levels in the company to determine if the product is well positioned and well priced. The quote to bind ratio can also inform carriers if the system’s rules and underwriting rules enable the agent to move through the policy life cycle effectively or if the agent is using the system appropriately and is serious about binding coverage with you. It can also help determine if there are changes in the ratio when you have made material changes to the product or the price of the product.

Of my quotes created in a set time period, how do I tell how many converted to become a policy?

The Quote to Bind Ratio Dashboard Report helps managers across the insurer’s company identify how many quotes converted to bound policies and to compare by date ranges.

WaterStreet Company & Quote to Bind Ratio

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.