Traditional methods of risk assessment have fallen short in recent years. That’s why the emergence of catastrophe modeling has brought a new era of risk assessment, enabling insurance experts to comprehend and mitigate complex perils driven by environmental factors.

WaterStreet Company’s P&C Insurance Solutions allow carriers to access all the data needed to form predictions.

What is Catastrophe Modeling?

Catastrophe modeling blends scientific insights, advanced data analytics, and computational algorithms to evaluate and predict the impact of catastrophic events on insurance portfolios. Unlike conventional risk assessment methods that rely on historical data, catastrophe modeling takes a proactive approach, factoring a wider degree of variables that influence potential losses.

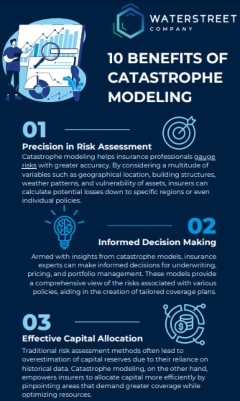

10 Benefits of Catastrophe Modeling

1. Precision in Risk Assessment

Catastrophe modeling helps insurance professionals gauge risks with greater accuracy. By considering a multitude of variables such as geographical location, building structures, weather patterns, and vulnerability of assets, insurers can calculate potential losses down to specific regions or even individual policies.

2. Informed Decision-Making

Armed with insights from catastrophe models, insurance experts can make informed decisions for underwriting, pricing, and portfolio management. These models provide a comprehensive view of the risks associated with various policies, aiding in the creation of tailored coverage plans.

3. Effective Capital Allocation

Traditional risk assessment methods often lead to overestimation of capital reserves due to their reliance on historical data. Catastrophe modeling, on the other hand, empowers insurers to allocate capital more efficiently by pinpointing areas that demand greater coverage while optimizing resources.

4. Enhanced Risk Communication

Clear communication with clients and stakeholders is paramount in the insurance industry. Catastrophe modeling simplifies the science behind risk assessment and allows insurers to effectively communicate potential scenarios to policyholders and facilitate a deeper understanding of their coverage.

5. Scenario Analysis

Catastrophe models thrive on ‘what-if’ scenarios, allowing insurance professionals to explore the impact of various disaster scenarios on their portfolios. This proactive approach equips insurers to devise strategies that can effectively mitigate potential losses.

6. Modernized Analytics

The traditional insurance landscape often falls short when assessing the influence of environmental factors on risk. With the rise in frequency and intensity of natural disasters, such as hurricanes, wildfires, and floods, insurers are compelled to adopt a more nuanced approach that takes into account climate change, urbanization, and other environmental dynamics. Here’s where catastrophe modeling steps in as a game-changer:

7. Climate Change Considerations

Catastrophe models can incorporate data related to climate change, helping insurers understand how shifting weather patterns might impact the frequency and severity of catastrophic events. This knowledge enables them to adapt their strategies, offer better coverage, and plan for contingencies.

8. Urban Development and Exposure

As urban areas expand, so does exposure to potential risks. Catastrophe modeling assimilates information on urban development, population density, and asset distribution to provide a clearer picture of vulnerability, ensuring insurers can address the needs of developing homes and businesses.

9. Technological Advancements

With advances in data collection and processing, catastrophe models can now incorporate real-time data streams, enabling insurers to monitor ongoing events and respond swiftly. This is particularly crucial during events like wildfires or earthquakes, where rapid decision-making can save lives and minimize losses.

10. Integration of Big Data

Catastrophe modeling leverages big data sources like satellite imagery, sensor networks, and social media feeds to enhance risk assessment accuracy. This integration provides a holistic understanding of ongoing factors, allowing insurers to adjust their strategies accordingly.

WaterStreet Company for P&C Insurance

Without a unified P&C insurance solution, insurers are unable to bring the variety of big data together for enhancing risk assessment.

Third-party integrations are essential for many carriers to bring important and supportive data into the system. These integrations can help assess location risks, provide a history of weather patterns, offer more background information on a new policyholder, allow for self-inspections, and many other unique capabilities. WaterStreet Company solutions are built with a robust API to connect to any number of third-party integrations.

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.