Each step of the quote to issue process pushes a policy transaction closer and closer to completion. It’s essential for P&C insurers to stay on top of transaction processes to ensure all gears are spinning and in tune across the company, benefiting all areas from customer service to underwriting.

Executives, underwriters, customer service managers, operations managers, marketing managers and product managers have reason to routinely check the most critical transactions. Nearly all areas of the business touch on furthering key transactions across the company. Offering insurance experts a view into actionable insights into transaction data can significantly unveil inefficient blind spots.

WaterStreet Company makes it easy to review and compare key information about P&C insurance transactions with our Business Intelligence Suite, including:

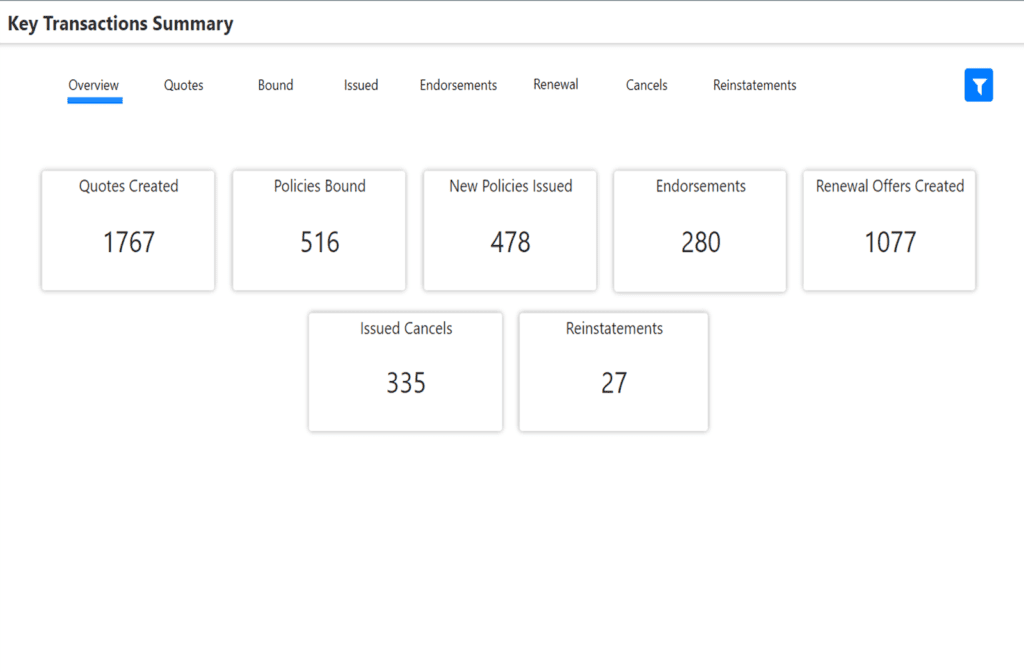

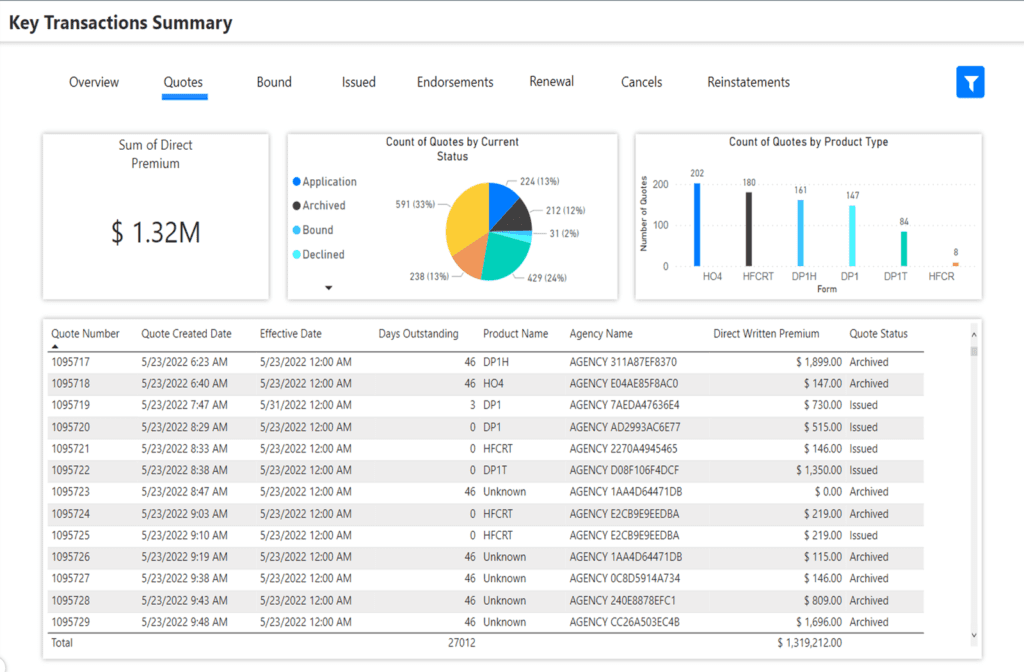

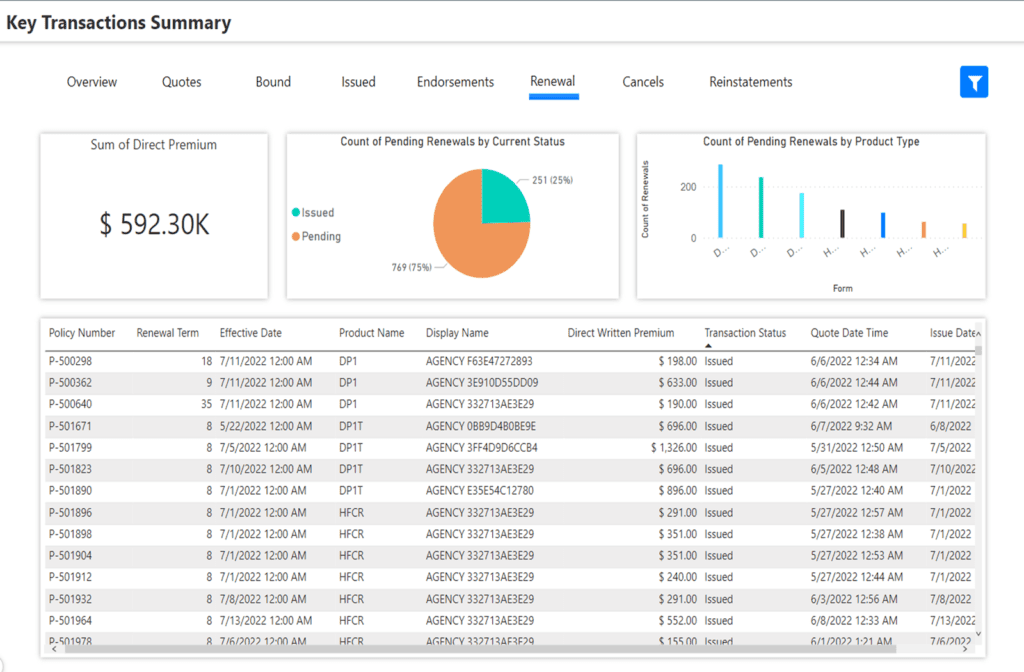

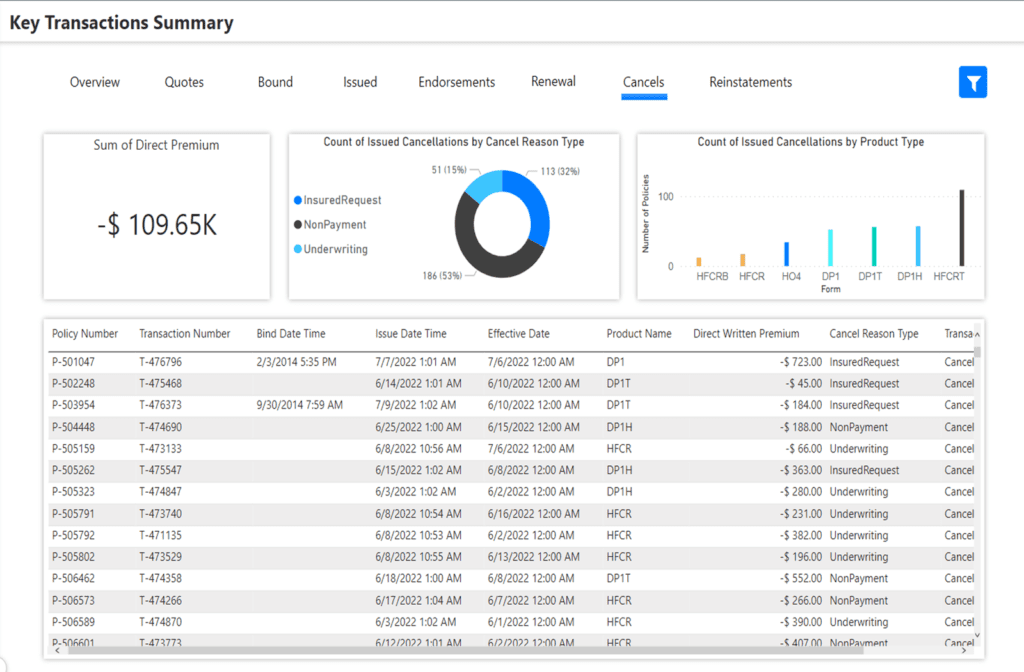

- Discover how many policies were quoted, bound, issued, canceled or offered a renewal within a given timeframe.

- Drill down into each category of the policy administration process within a given timeframe.

- Uncover trends in transactions by status, product type, and tabular lists.

- Keep track of the critical transaction statuses for policies moving through the quote to issue process.

- Flexibly define relative dates, whether by month or year.

- Set a cadence to generate your report and routinely check benchmarks.

Key Transactions Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

What are the most common stopping points that could delay a critical transaction between the quote to issue process?

It’s essential for the team to catch coming stopping points in the quote to issue process. Many of these stopping points include:

- The quote doesn’t automatically fit within the underwriting guidelines and may require answers to further edit and adjust rules.

- There may be missing information or delays in receiving additional documents, such as inspections, alarm certificates, or flood zone certificates.

- There may be further agent or underwriter interactions regarding necessary information, slightly non-conforming risk to review, or loss history questions.

- The price could cause the prospect to delay their decision.

- Waiting for a home sale to close.

- Clunky, inefficient systems or understaffed underwriting or customer service personnel could fall behind in reviews.

What are the most helpful timeframes to view transaction summaries?

Be sure to stay on top of the various transaction cycles, including:

- New business quotes and applications that require some sort of review by an underwriter or customer service representative.

- Watch for renewals if there are underwriting, coverage, or pricing changes on the renewals that could require vigilance and responsiveness to policyholders.

- Ensure endorsements are processed timely.

The carrier must have a process to ensure all transactions can be easily viewed, scheduled and addressed in a timely manner as an essential element to outstanding customer service. Giving various internal experts access to this information with ability to analyze at the portfolio level as well as drill down to the individual policy level brings outstanding benefits in managing resources and delivering great service.

How can I act on this report if I find a negative trend in transactions by product type?

One of the primary purposes behind the Key Transactions dashboard, graphics and summary data is to quickly identify a negative trend, poor performance under a Service Level Agreement, and backlogs or delays.

A negative trend in underwriting ordinarily means results that are not meeting guidelines or goals. The more quickly discovered, the more quickly a remedy can be implemented, or at least the bleeding stopped through implementation of new underwriting rules, suspension of writing certain risks, and alerts to agents.

WaterStreet Company & Key Transaction Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.