When evaluating profit goals, the size of policy products can help unveil adjustments to pricing. When all factors total behind the cost of a policy, from expected losses to overhead, reviewing the sizes of the insurer’s policies opens a path towards optimizing pricing.

Executives, underwriters, product managers and other product-oriented roles have interest in evaluating the average policy size. This exercise can help compare the company against competition and identify where prices need to be adjusted to fit internal goals.

WaterStreet Company makes it easy to review and compare key information about policy size with our Business Intelligence Suite, including:

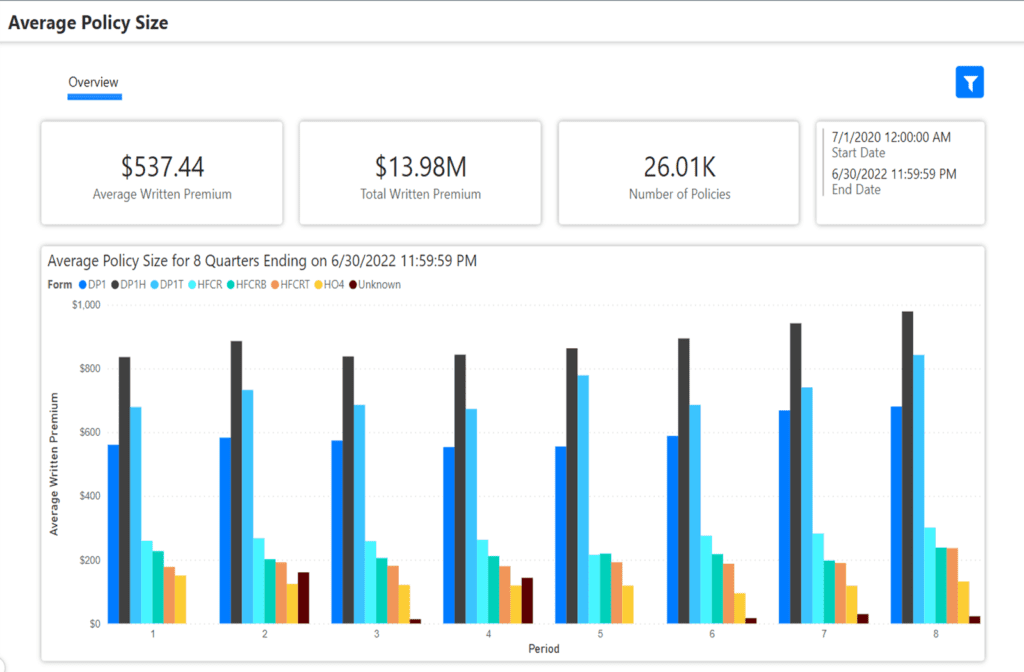

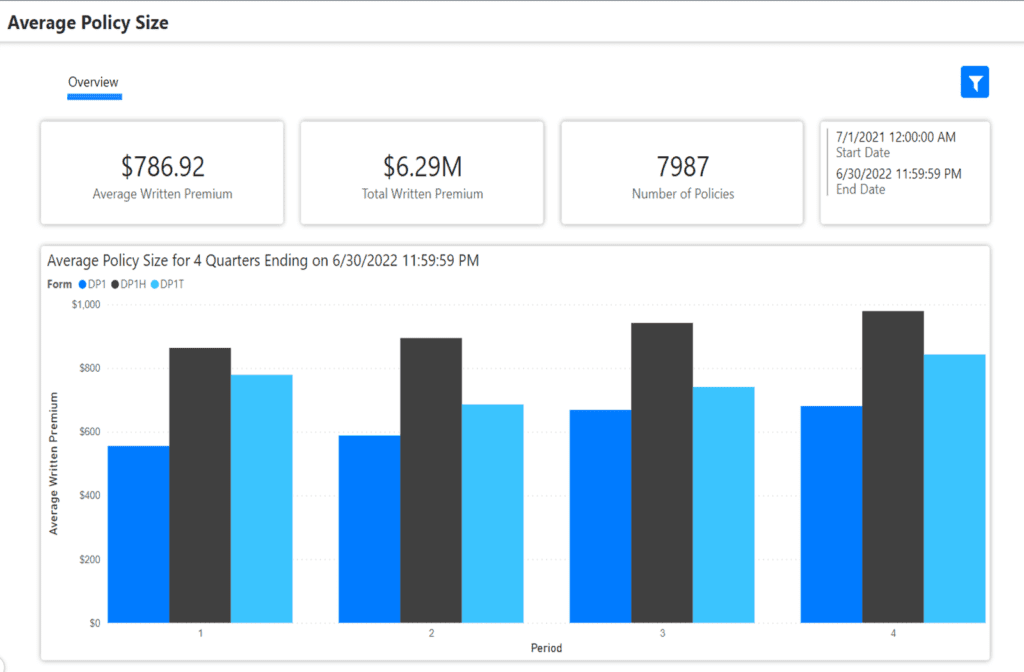

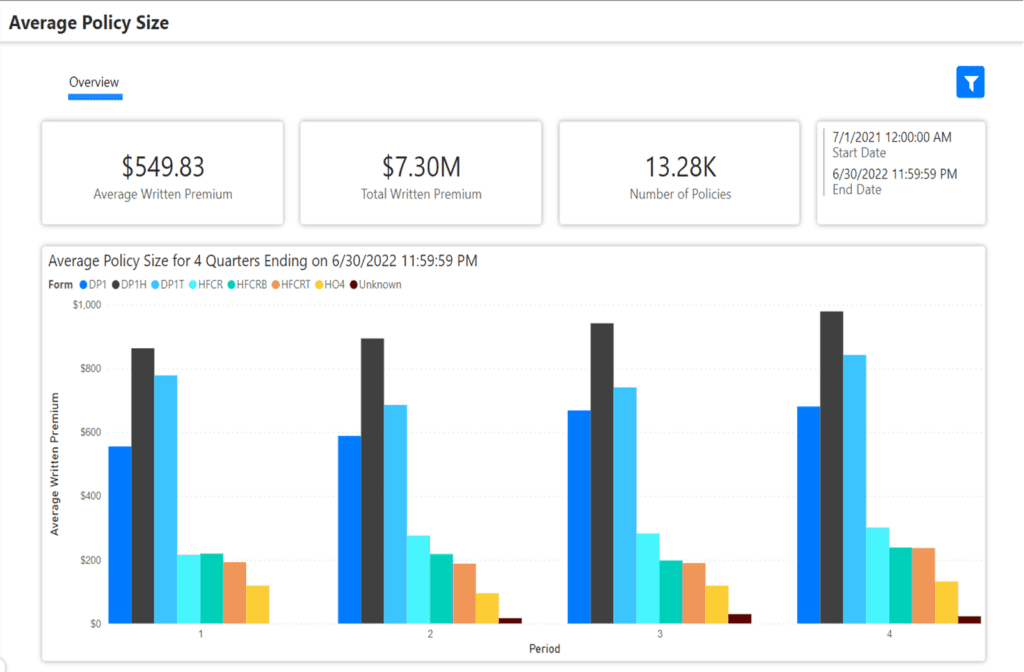

- Analyze the average policy size and average written premium for different products based on year, quarter, month, policy periods, product state, form, agency name, and more.

- Review changes in average premium over time for various products.

- Indicate the industry average of product sizes for comparison against your own company’s data.

- Easily adjust geographic sliders for identifying the reach of your company’s products.

Policy Size Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

Why does evaluating the size of my products matter?

Evaluating the policy size helps to determine if the insurer is charging enough premium on each policy to pay claims, reinsurance costs, agent commissions, and the insurer’s expenses. If the insurer charges too little, the company won’t routinely and over time cover all of these expenses, and it will generate underwriting losses. The company can’t stay in business if it can’t make a profit.

What are the most important factors for me to focus on when reviewing the size of a product?

Insurers tend to know what the expected losses and expenses are running as a percentage of the total premium, and thus insurance experts can determine on this information what the average premiums need to be in rating territories in order to produce a profit.

It’s also important to know what competitors are charging. The company must decide where to stand compared to the competition in every territory where business operates.

What factors should I look into when expanding a product’s size?

Consider determining what portion of the overall policy premium may need to be increased to reach a more adequate level. This review could be needed for any number of coverages, deductibles offered, increased limits, or endorsements and special coverage options.

WaterStreet Company & Policy Size Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.