Renewal offers can make or break an insurer’s predictable revenue. Many strategies can be used to entice renewals, or even discourage renewals. Insurance experts are able to carefully change underwriting rules and product pricing during opportune times to help shift trends in the customer base.

Executives, underwriters, operations managers, marketing managers and product managers all take part in monitoring the renewal offer process.

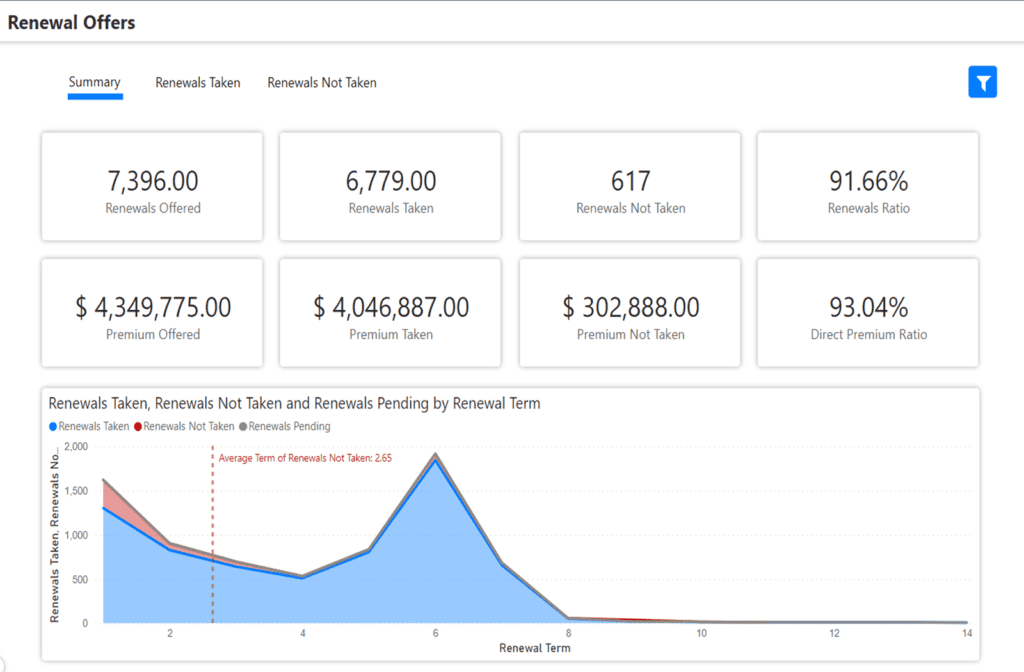

WaterStreet Company makes it easy to review and compare key information about renewal offers with our Business Intelligence Suite, including:

- Track renewal metrics against company goals.

- Compare renewals taken against renewal offers not taken.

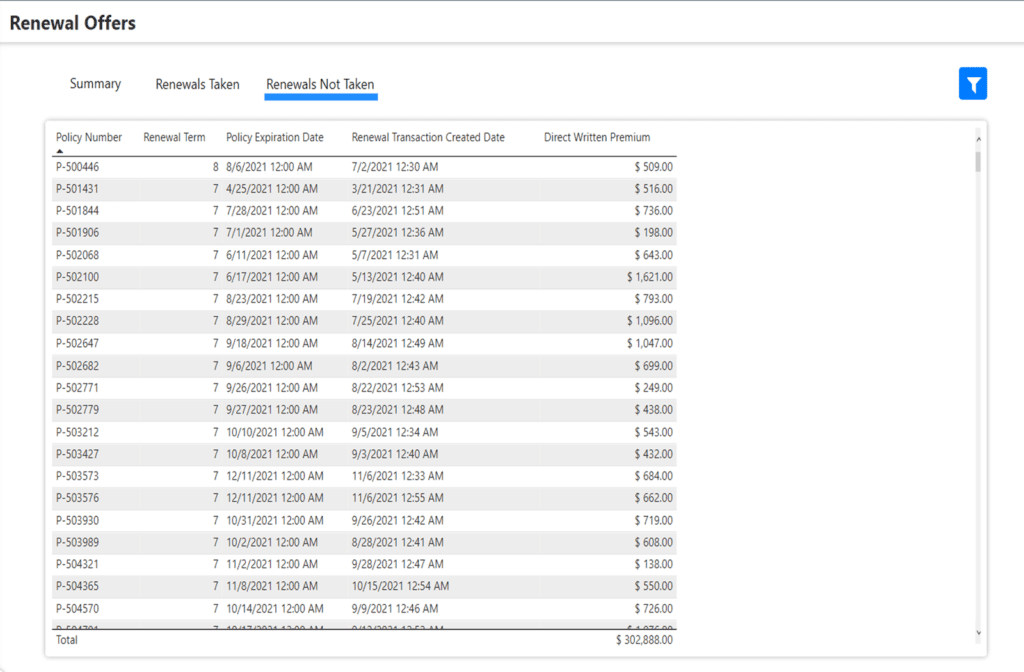

- Know when a renewal offer not taken has expired.

- Look deeper into trends for why renewals offered are not taken.

- Get a better understanding of customer retention.

- Set goals to maintain and improve conversion rates.

- Identify when the renewal ratio is lower compared to the direct premium ratio to show when higher premiums are offered.

Renewal Offers Analytics

“With WaterStreet’s Business Intelligence Suite, every user becomes an instant analyst, gaining efficiencies with automation in day-to-day reporting processes as well as improving overall decision-making with reliable data,” – Kelly King, CFO, WaterStreet Company.

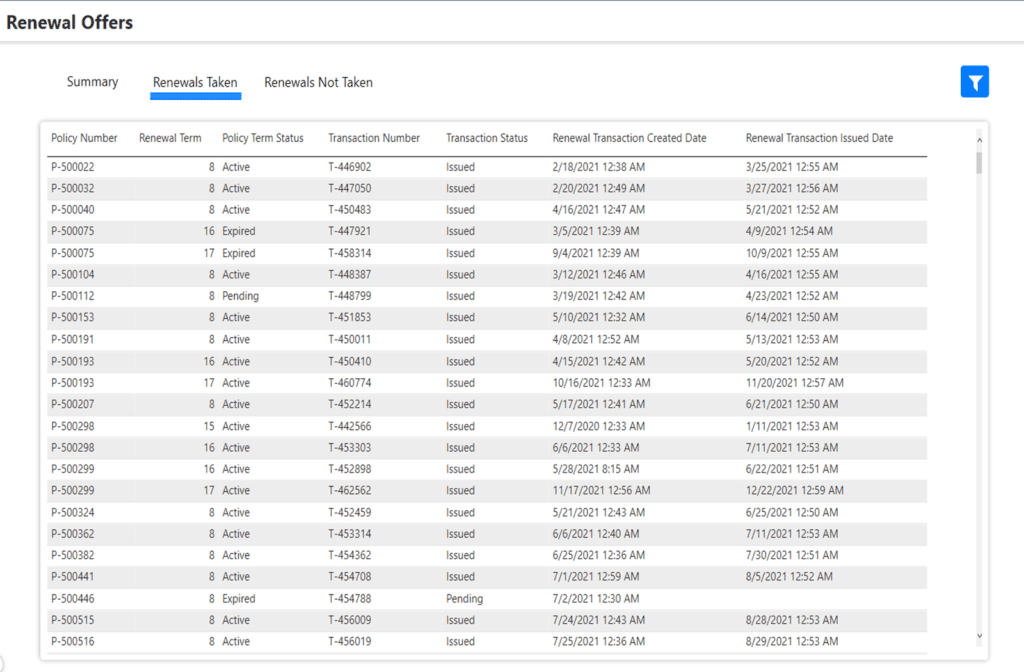

What is the difference between the transaction status issued and pending when it comes to a renewal?

A renewal issued means payment has been received and the effective date of the renewal has occurred. A renewal pending means a renewal offer has been sent, usually a set number of days ahead of the effective date, and has not yet reached its renewal effective date.

Why is it important to track renewals offered but not taken?

When a renewal offer is given to a customer but not taken, insurance experts often run exercises to discover why the customer was lost. The following questions are commonly asked among the team:

- Was the price too high?

- Was there a less expensive option offered by a competitor?

- Did the company make a policy change, causing the customer to shop for a better deal?

- Are agents steering business away from our company or towards a competitor?

Be sure to identify the target retention rate, for example, a 90% retention. If the actual retention rate is below that insurer’s goal, searching for reasons in the renewals not taken is one source of intel to improve the renewal retention rate.

What insights might be found when looking closer to renewals offered but not taken?

Sometimes, the insurer might make price and underwriting changes intended to cause people to shop elsewhere. Insurance experts can review and compare renewals not taken against those taken to see if the intended results occurred. It could be that customers renew who you wished didn’t, and those you wish stayed decided to go elsewhere.

If material changes were not made with intentions to impact renewals, then a deeper dive into those that left is warranted to devise a strategy to reverse the trend.

WaterStreet Company & Renewal Offer Analytics

WaterStreet Company aims to deliver best-in-class solutions for P&C insurers. This year, we’ve launched our Business Intelligence Suite to help insurers track vital key performance indicators specific to the insurance industry.

We provide advanced P&C Insurance Software designed to grow with your business, allowing integration with next-generation solutions.

Ready to Take Action?

Reach out to WaterStreet Company today to request a consultation and demo of our solutions.