Achieve accurate and efficient risk assessment with WaterStreet’s all-in-one integrated solution encompassing a built-in rating engine, policy administration, claims management, document management, and seamless integration with third-party web services.

Streamlined Underwriting Management

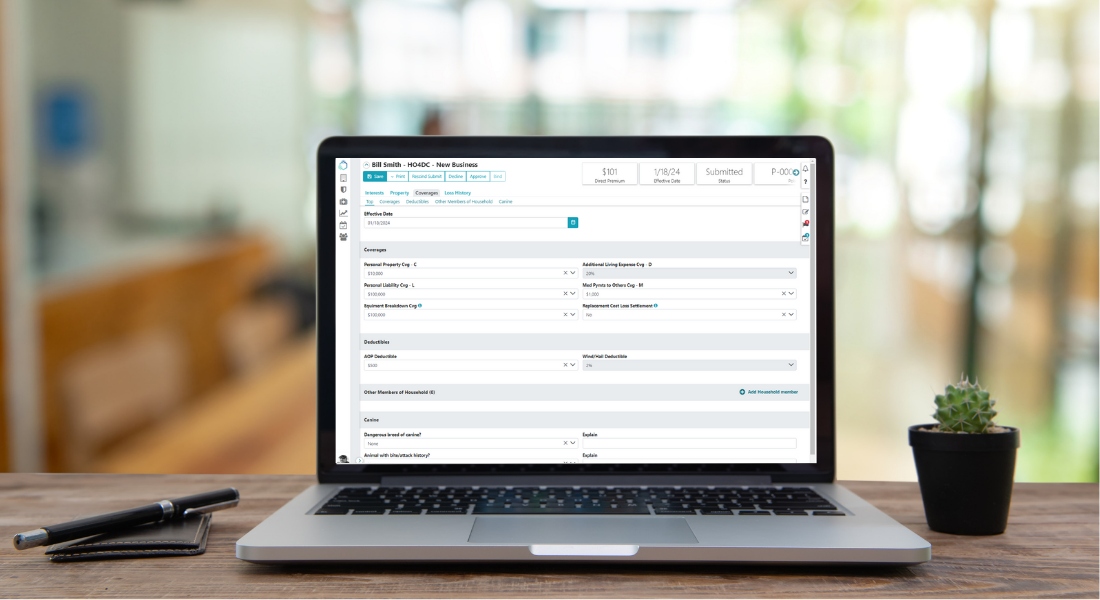

Establish standardized rules and guidelines for each product, guiding agents and producers through the quote-to-issue process. The system ensures meticulous attention to detail, triggering flags and alerts for circumstances outside established standards.

Business Process Automation

Automate tasks based on configurable business rules in real-time. Implement data validation to trigger warnings, referrals, and compliance notifications to ensure new policies comply with underwriting rules.

Collaborative Workbench

Facilitate seamless collaboration between underwriters and producers within a unified system. This enables efficient task management and the recording of essential memos on each transaction, ensuring clear communication and eliminating oversights.

Agile Change Management

The WaterStreet Platform’s flexibility allows swift implementation of product changes. Stay ahead in the ever-evolving insurance landscape, adapting to new technologies and emerging risks with ease.

Risk Assessment and Action

Access key data insights with best-in-class underwriting analytics tools. Identify risk trends and anomalies. Make data-driven decisions about risk selection criteria for your products.

Integrate with Third-Party Providers

Our Open API facilitates integration with any number of desired third-party solutions to support underwriting decisions.

Insurance Rating Engine & Underwriting Software

Streamline your underwriting with WaterStreet’s advanced rating engine. Our software empowers underwriters to assess risk accurately and efficiently while managing strategic decisions with ease. By unifying all underwriting processes, we enhance profitability, growth, and retention. Underwriters can analyze workflows, respond to agents, and quickly update rules within a seamless, efficient system.

Key Underwriting Software Features

Manage All Transactions Throughout the Policy Lifecycle

New Business Transactions, Policy Change Transactions, Renewal Transactions, Non-renewal Transactions, and Cancellation Transactions.

Underwriter Checklists

Ensure all necessary steps and considerations are addressed before a decision is made on a policy.

Rules Engine

Automate decision-making based on predefined rules and criteria.

Multiple Policy Support

Enables the management of multiple policies under a single account or entity.

Account Summary View

Consolidates key information, such as policy details, coverage limits, and premium summaries.

Workflow & Task Automation

Never miss a task with automated work items.

Variable Binding & Approval by Role

Role-based permissions and responsibilities, ensuring a controlled and efficient workflow aligned with organizational structures.

Business Rule Alerts & Guided Resolutions

Simplify your workflow with a fully configured policy administration system that is customized to the insurers V underwriting guidelines.

On-Demand Support

Access in-app help articles and walkthroughs for instant guidance.

Want to see our

products in action?

Schedule a demo today by calling us at 406.333.1989 or filling out the form via the following link.

”Having been with WaterStreet for a few months, I am very happy with the system and their services team and I know that PICA made the right partner choice.

Ned DolesePresident, Property Insurance Company of America

Want to see our

products in action?

Schedule a demo today by calling us at 406.333.1989 or filling out the form via the following link.

”Having been with WaterStreet for a few months, I am very happy with the system and their services team and I know that PICA made the right partner choice.

Ned DolesePresident, Property Insurance Company of America